Download "The 8 FATAL Finance Traps" eBook Now!

Discover the key

to safeguarding your SMSF investment!

Are you considering buying an investment property within your SMSF?

It's a fantastic opportunity to turbocharge your wealth and secure a prosperous future.

But hold on!

Before you take the plunge, we have a critical message for you.

Introducing our groundbreaking e-book:

"The 8 FATAL Finance Traps to Avoid When Buying an Investment Property within your SMSF." 📚

This must-have guide is your ticket to avoiding costly mistakes that could potentially derail your dreams.

Here's the scary part...

Trap #4 has the power to DOUBLE your costs! 💥

Don't let this trap sneak up on you and drain your hard-earned superannuation savings. Take control of your financial future by downloading our e-book right now!

Why should you be excited about this book? We've crafted it with one goal in mind: empowering you to make sound investment decisions that yield phenomenal results. This isn't just any ordinary guide; it's your secret weapon to outsmart the risks and seize lucrative opportunities!

We've packed it with game-changing insights and expert advice from seasoned professionals who have navigated the tricky waters of SMSF investing and lending.

Inside the the '8 FATAL FINANCE FLAWS you'll uncover:

1️⃣ Confirming your eligibility to buy and borrow through your SMSF.

2️⃣ Purchasing the property in the right name to comply with state-based rules.

3️⃣ Avoiding the pitfall of incorrect calculations and unrealistic borrowing expectations.

4️⃣ The crucial concept of 'Single Acquirable Asset' and why it matters.

5️⃣ Understanding the unique risks and nuances of SMSF property investment.

6️⃣ Navigating commercial property purchase structuring to optimize your returns.

7️⃣ Escaping the loyalty tax by reviewing your loan regularly.

8️⃣ Building your 'A' Team of SMSF specialist professionals for effective self-management.

Award-winning value

We don't mean to brag but....

![]()

Priscilla Hill

Mark and his team assisted us with a Self-Managed Super Fund Loan to purchase commercial premises for our buisness recently and we found them to be very professional, knowledgeable and true experts in this field. We were very new to SMS Funds, and Mark always took the time to ensure we were informed every step of the way. His guidance and assistance were exceptional throughout the whole process. We highly recommend Mark and his team at MAB.

![]()

Sara Boase

Mark and his team at Mortgage Advice Bureau were amazing. Our requirements were not straight forward but they found us a solution. They worked with professionalism, integrity and applied their knowledge to help us achieve the best result possible. Highly recommend Mark and Pragati, wouldn’t go anywhere else

![]()

Vaness Barons

Mark recently helped us to restructure our primary home loan to release equity for further investment and also refinanced our SMSF Home Loan to take benefit of improved rates. Mark and the MAB team were extremely professional, listened rather than telling and very responsive to any questions or issues that arose during the process. Overall I would not hesitate to recommend Mark and the MAB team for any financing discussions.

Here is a quick sneak peak of what you can find in our guide!...

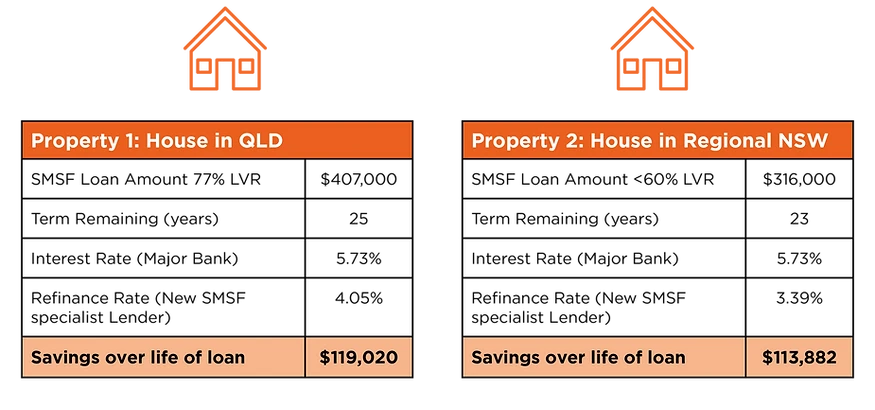

FATAL FLAW #7 Having a set and forget loan – paying a loyalty tax for not reviewing it. In the ebook we run through how not reviewing your smsf loan might result in paying a ‘loyalty tax’ of an extra 1 or even 2 percentage points –which, over the life of the loan, could erode your retirement savings by tens of thousands of dollars.

A quick word on Mortgage Advice Bureau Sydney

MAB Sydney is a high performing, multi-award winning, dynamic team with a strong focus on assisting clients with complex needs that extend beyond straight forward home loans. Since inception they have carved out a niche as one of the leading SMSF lending brokerages in the country helping clients build wealth for their retirement through property.

Mortgage Advice Bureau is a leading mortgage broker brand in both the United Kingdom and

Australia, winning over 150 international awards for exceptional advice standards through industry leading brokers.

The MAB Sydney team don’t just stop after the SMSF Loan. Via our Care Beyond the Finance Program, we are able to add value to our clients in a multitude of ways through integrated and aligned services, as well as a multi-disciplinary network of aligned finance and property professionals.

All MAB Sydney brokers are highly credentialed, university educated professionals with decades of combined experience in finance. Your SMSF loan will be in the best hands!