Shifting individuals from low to very high financial wellbeing

65.6%

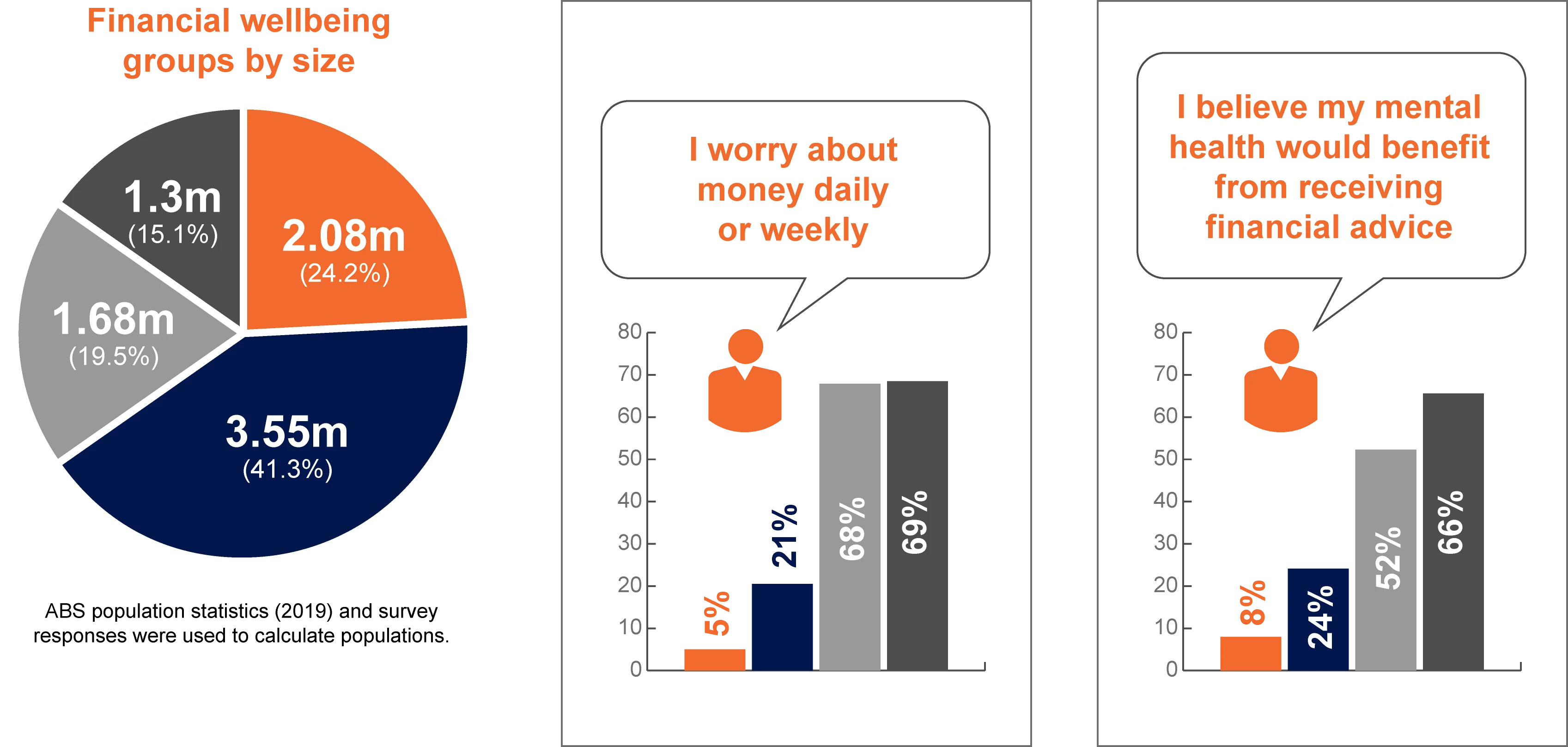

of those with low financial wellbeing believe that their mental health would benefit from financial advice

Statistics that speak for themselves

Employees who have a mortgage are 8 times more likely to have sleepless nights

Employees are 7 times more likely not to finish their daily tasks at work if they have money worries.

Of employees said they would be more likely to stay at a job if their employer offered financial wellness benefits.

What is financial wellbeing?

Financial wellbeing is highly driven by an individual’s certainty in their life and financial situation, and a positive sense of how they are doing in achieving their financial goals. Financial wellbeing is generally linear with age and the uncertainty attached to an individual's life-circumstances and health. But other factors come into play such as, savings and debt.

The conclusion we can draw from the below statistics is that lower levels of financial wellbeing lead to greater money worries and less optimism about the future.

Increasing employee financial wellbeing

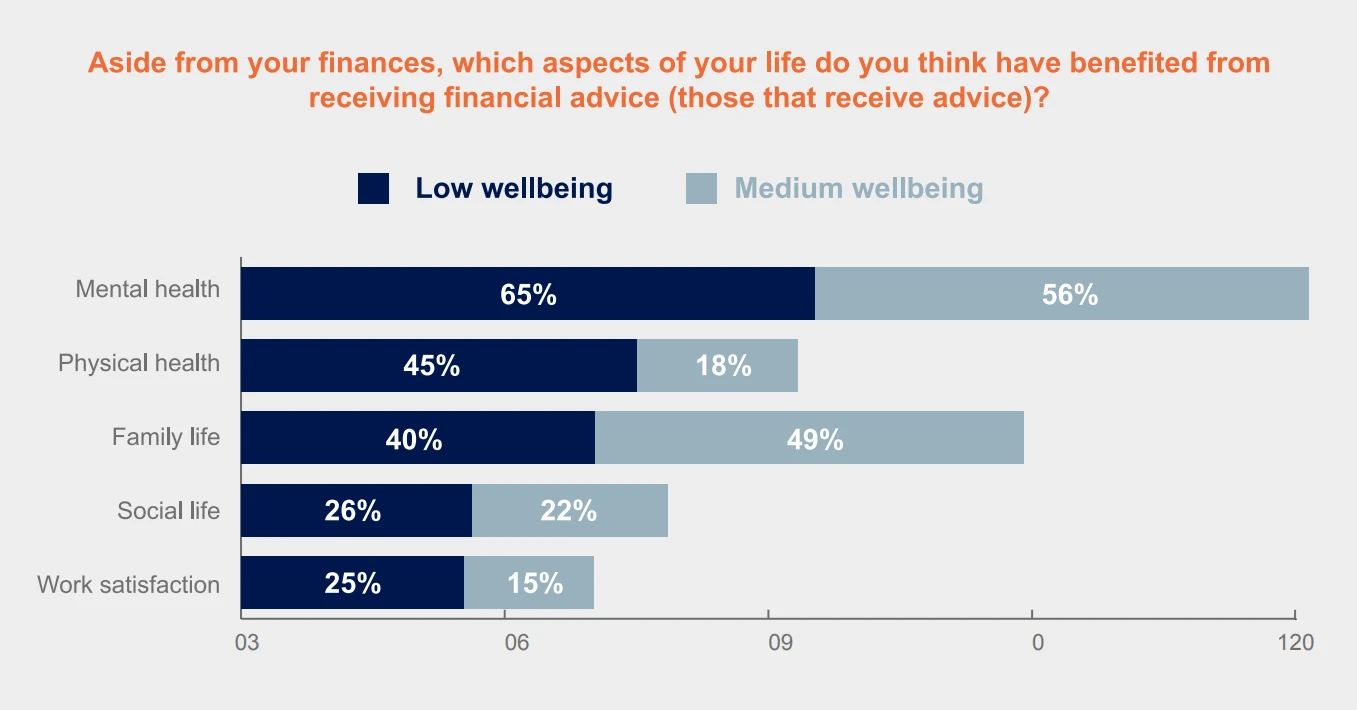

Those that receive advice with low financial capability can benefit beyond improving their wealth,extending to their health and social fabric.

How we can help your employees

We offer a dedicated employee benefit service to ensure your staff not only have access to fee free mortgage advice when they need it, but also help and education to support their overall financial well-being.

Whatever the circumstance, we can give you peace of mind that your employees are being looked after, and that those with money worries will have one less thing to worry about.

Topics we can cover:

- Ways to pay off your mortgage quicker

- Should you refinance? Is it worth it? What deals are available?

- Best digital apps to monitor your finances

- Savings for your first home

- Will your current lender drop their rate?

- Paying off credit cards and consolidating debt

- Buying an investment property

- Cashbacks for changing banks - what's the catch?

Introducing

Mortgage Advice Bureau

We are a leading mortgage broker brand, winning over 200 international awards for the quality of our advice and service.

With over 1,600 brokers across the UK and Australia, we offer expert mortgage advice on a local, regional and national level to our customers, both face to face and over the phone.

The expert advice we offer, combined with the volume of mortgages that we arrange, places us in a very strong position to ensure that our customers have access to the latest deals available and receive a first-class service.