A year of two halves is what financial experts are calling 2025.

Coming off the back of a weakened housing market, where property prices declined in four out of the eight capital cities during 2024, we’re likely to see the market remain soft in the first half of 2025.

However, the outlook brightens as the year progresses, with anticipated cash rate cuts likely to spark renewed activity in the market.

A reduction in the cash rate typically paves the way for lower mortgage interest rates. This could bring welcome relief to borrowers, making home loans more affordable. Historically, lower borrowing costs often entice buyers back into the market, increasing competition for properties and driving up prices.

Additionally, Australia’s ongoing housing supply constraints may also amplify price growth. With new housing developments lagging behind population growth, the imbalance between demand and supply remains a critical factor underpinning rising house prices.

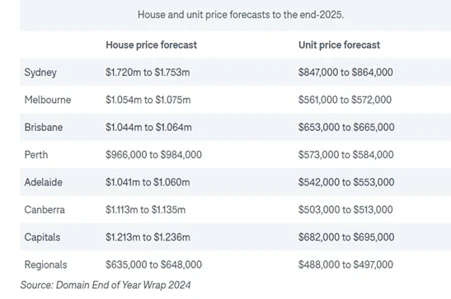

By the end of 2025, Domain predicts the median house price in the combined capital cities will rise by 5 - 7%, bringing it to $1.213 million. Notably, five out of the eight capital cities could have a median house price of $1 million or more.

If you would like to explore property investment loans, click here to talk to a mortgage broker.